On Thursday, according to Reuters citing a representative, OPEC+ has reached a consensus to delay the plan to increase oil supplies by two months.

Following the news that OPEC+ agreed to postpone the production increase scheduled for October by two months, WTI crude oil futures once surged by about $1, to above $70.40 per barrel, with an overall daily increase of more than 1.3%.

This is similar to the reports on Wednesday, only more advanced. Yesterday, more than one media outlet reported that OPEC+ was considering delaying the production increase. International crude oil futures saw a short-term lift during the trading session on Wednesday, rising by more than 1% at one point, but the boost from the news was limited, and oil prices subsequently fell back into negative territory, with U.S. oil falling by more than 2% at one point.

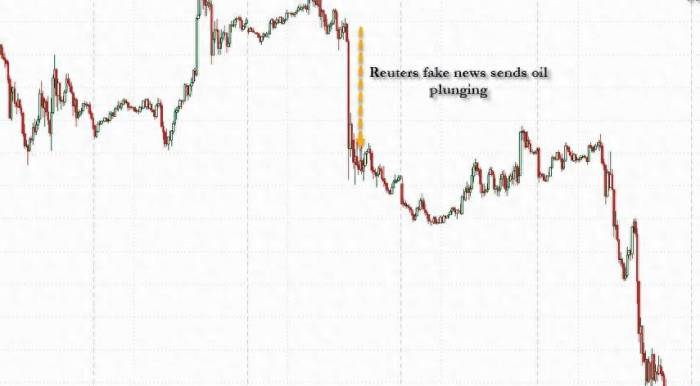

The stance of OPEC+ reported this week represents a significant reversal from last Friday. Last Friday, also reported by Reuters, OPEC+ planned to advance the previously proposed production increase in the fourth quarter of this year. According to the original plan agreed upon by OPEC+ in June this year, starting from October, the OPEC+ agreement countries led by Saudi Arabia and Russia will gradually resume oil production and phase out the voluntary production cuts of 2.2 million barrels per day by eight agreement countries. In October, OPEC+ will increase production by 180,000 barrels per day.

Advertisement

The news that OPEC+ might continue to increase production last Friday led to a significant drop in oil prices that day. On Tuesday of this week, hopes for Libya to return to normal oil production and exports increased significantly, adding to the downward pressure on oil prices. For the first time since December last year, U.S. oil closed below the $70 mark this week, and Brent oil reached its lowest closing level since June last year.

The significant shift in OPEC+'s stance in a short period comes amid concerns over weak global economic data and demand worries, with oil prices in an extremely depressed state. The organization has previously emphasized that it can suspend the production increase plan if necessary, or reverse course and continue to cut production.

Some market observers are concerned that global crude oil inventories will increase in the first half of 2025. However, based on this week's inventory data, U.S. crude oil inventories continue the general downward trend seen previously and have dropped to their lowest level since January this year.

Data from the U.S. Energy Information Administration (EIA) on Thursday showed that U.S. EIA crude oil inventories decreased by 6.873 million barrels last week, with Bloomberg subscribers expecting a decrease of 3.97 million barrels, and analysts expecting a decrease of 378,710 barrels, compared to a decrease of 846,000 barrels the previous week. U.S. crude oil inventories have fallen for nine out of the last ten weeks.

Data from the American Petroleum Institute (API) after the U.S. stock market closed on Wednesday showed that U.S. API crude oil inventories plummeted by 7.4 million barrels last week.

Other important parts of the EIA data for the week ending August 30 in the United States are as follows:WTI crude oil inventories at Cushing, the delivery point, decreased by 1.142 million barrels, compared to the previous decrease of 668,000 barrels.

The Biden administration added 1.8 million barrels of crude oil to the Strategic Petroleum Reserve (SPR), marking the largest increase since June 2020.

Gasoline inventories increased by 848,000 barrels, against expectations of a decrease of 1.11 million barrels, and the previous decrease of 2.203 million barrels. This reversed the downward trend of the previous three weeks.

Distillate inventories decreased by 371,000 barrels, against expectations of an increase of 410,000 barrels, and the previous increase of 275,000 barrels.

Refinery utilization rate remained unchanged at 0%, against expectations of a decrease of 0.8%, and the previous increase of 1%.

U.S. crude oil production remains at historically high levels, despite the continuous decline in the number of oil rigs.

Despite the fact that most of the inventory data continued to decrease, except for the unexpected increase in gasoline inventories, the oil prices did not maintain the gains after OPEC+ agreed to suspend the increase in supply, and the gains were given back.

On Thursday, WTI crude oil futures for October closed down by $0.05, or 0.07%, at $69.15 a barrel, setting a new closing low since June 2023. Brent crude oil futures for November closed down by $0.01, or 0.01%, at $72.69 a barrel.

The financial blog Zerohedge commented:

The continuous drawdown of Cushing inventories implies that a few more weeks of such a downward trend will have everyone talking about the bottoming out of oil tanks. Cushing inventories are rapidly approaching the 20 million barrel level, which many consider to be the bottom of the tank.Despite the plummeting of U.S. inventories, despite the risk of tank bottoms in Cushing inventories, and despite the OPEC+ decision not to increase production, oil prices continue to follow the previous downturn, as bears now dominate the market.

However, as demand remains flat or even rises, the room for further reduction in inventories is limited, which will ultimately lead to an unprecedented confrontation between paper prices and physical prices, as well as a comprehensive physical oil crisis, which will put shorting CTA traders in a difficult position.

Comments