On Friday, September 6, Eastern Time, all three major U.S. stock indexes closed lower. For the week, the Dow Jones Industrial Average and the S&P 500 both posted their worst weekly performance since March 2023. The August non-farm employment data fell short of expectations, and there was a divergence of opinions in the market regarding the extent of the Federal Reserve's rate cut. Bad news also suddenly hit the U.S. chip stocks, with Tesla plunging.

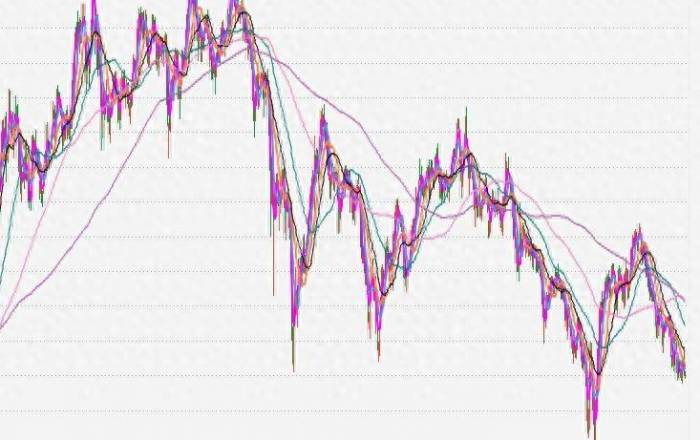

After the release of the U.S. August non-farm employment report, the U.S. stock market suddenly faced a sharp sell-off. By the close, the Nasdaq Composite Index plummeted 2.55%, the S&P 500 Index fell 1.73%, and the Dow Jones Industrial Average dropped by more than 410 points, falling 1.01%.

In terms of news, on the evening of September 6, Beijing Time, the U.S. Bureau of Labor Statistics released the August non-farm employment report, which showed that the U.S. non-farm employment increased by 142,000 people in August, lower than the expected 165,000, and the previous value was an increase of 114,000; the U.S. unemployment rate in August was 4.2%, in line with expectations, slightly lower than the previous value (4.3%), marking the first decline since March this year.

Analysts believe that after the weak non-farm data, investors continued to sell off technology stocks. Emily Roland, co-chief investment strategist at John Hancock Investment Management, said, "This is an emotion-driven move, mainly driven by concerns about U.S. economic growth."

Advertisement

In addition, the U.S. stock market had a difficult "start" in September, with the Dow Jones falling 2.93% for the week, the S&P 500 falling 4.25%, and the Nasdaq falling 5.77%. Among them, the Dow Jones and the S&P 500 both recorded their largest weekly decline since March 2023, ending a three-week winning streak. The Nasdaq recorded its largest weekly decline since January 2022.

The U.S. technology "big seven" all dived, with the Wind U.S. TAMAMA Technology Index falling 2.9%, Tesla falling 8.45%, Apple falling 0.7%, Amazon falling 3.65%, Netflix falling 2.61%, Google falling 4.02%, Facebook falling 3.21%, and Microsoft falling 1.64%.

In terms of news, U.S. Senator Elizabeth Warren wrote to U.S. Assistant Attorney General Jonathan Kanter on September 5, local time, expressing support for the Department of Justice's investigation into Nvidia. "Allowing a company to exert such a significant influence on the research, development, and monetization of artificial intelligence poses terrible economic risks," Warren said.

On September 6, Eastern Time, Federal Reserve Governor Waller said that considering the continuous progress made in inflation and the cooling of the labor market, it is time to lower the target range of the federal funds rate. He stated that determining the pace of rate cuts and the overall magnitude of the final policy rate reduction is a decision to be made in the future. If appropriate, he will advocate for "front-loaded" rate cuts and maintain an open attitude towards the magnitude and speed of rate cuts.

Regarding the labor market, which is highly watched by the market, Waller pointed out that the U.S. job market continues to soften but has not deteriorated. The unemployment rate has risen, mainly due to an increase in labor supply. Compared with inflation, the risks faced by employment are more prominent. On the inflation front, Waller believes that it is on the right track to reach the Federal Reserve's 2% inflation target. Waller also stated that the U.S. economy is neither in a recession nor expected to head towards one.In response to Waller's latest speech, the well-known financial journalist Nick Timiraos, who is dubbed the "New Fedwire," analyzed that his speech did not explicitly mention 25 or 50 basis points. He tends to support an initial rate cut of 25 basis points, clearly reserving the option to accelerate the rate cuts in a timely manner if new data shows further deterioration.

This interpretation directly dampened the market's overly optimistic expectations, leading to a rapid retraction of the market's rate cut expectations and a significant downturn in the U.S. stock market.

In two weeks, the Federal Reserve will hold a two-day policy meeting, which means that central bank officials are approaching a ten-day "quiet period." Currently, the market has not yet reached a conclusion on the possible extent of the rate cut. Former U.S. Treasury Secretary Lawrence Summers stated that the non-farm report has made predictions more complicated.

The market believes that it is still necessary to observe next week's CPI data. The Federal Reserve is not expected to make a substantial rate cut in September that would confirm recession fears, and it will remain cautious about the risk of inflation rebounding due to excessive rate cuts. Therefore, a 25 basis point rate cut in September seems more likely, while the rate cut in November may be larger. Eventually, the market gradually reaches a consensus, with the probability of a 50 basis point rate cut being halved to 27%, and the possibility of a 25 basis point rate cut rising to 73%. This has led to an increase in the dollar and U.S. Treasury yields, with the U.S. dollar index rising nearly 0.34% during the day, a plunge in the U.S. stock market, and a significant drop in gold prices.

Comments